The New York Times has picked up on a story that’s been doing the rounds in Prague for some time now: the Czech banks are doing just fine. As in, they’re profitable – earning dividends for their western owners – and their level of non-performing loans has dropped from 6.4% to less than 6%. It attributes their stability to their having stuck to the rather more boringly traditional activities of banks, like lending money to people and companies, rather than seeking super-profits in the sexier areas of investment banking.

“The industry is in good shape; the sector is stable and has not needed any assistance in the recent crisis,” said Jiri Busek, an analyst with the Czech Banking Association. “It’s quite a unique position in Europe, and we are grateful for it. We are stable, healthy and profitable.”

Now, anyone who knows anything about the way things went down here knows that Czech banks have their share of issues in the property sector. Nobody came out of the boom smelling like roses. The Czech economy is currently in its longest recession and isn’t exactly galloping back to growth.

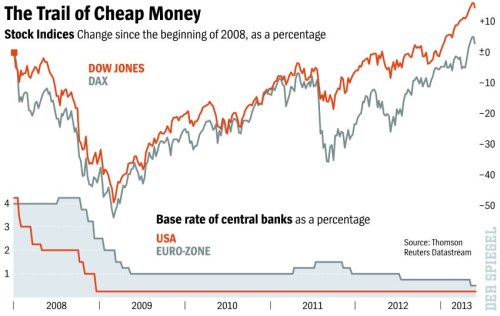

Does the name Ambrose Evans-Pritchard ring any bells? He’s the (self-acclaimed) prophet at the Daily Telegraph who back in 2009 tried to wreck all faith in this region’s banking sector by warning that western banks had billions of euro of exposure in the sewer of CEE. “Failure to save East Europe will lead to worldwide meltdown” (that’s the actual headline) made for thrilling, shiver-inspiring reading at the time. Reading the it today makes clear the dangers of quoting adrenalin-induced predictions of economists and doomsday headlines. Remember, this is 2009:

“A failure rate of 10pc would lead to the collapse of the Austrian financial sector,” reported Der Standard in Vienna. Unfortunately, that is about to happen.

The European Bank for Reconstruction and Development (EBRD) says bad debts will top 10pc and may reach 20pc. The Vienna press said Bank Austria and its Italian owner Unicredit face a “monetary Stalingrad” in the East.

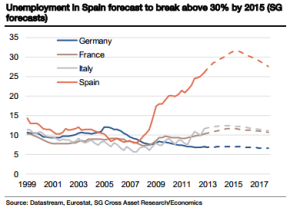

The implications are obvious. Berlin is not going to rescue Ireland, Spain, Greece and Portugal as the collapse of their credit bubbles leads to rising defaults, or rescue Italy by accepting plans for EU “union bonds” should the debt markets take fright at the rocketing trajectory of Italy’s public debt (hitting 112pc of GDP next year, just revised up from 101pc – big change), or rescue Austria from its Habsburg adventurism.

So we watch and wait as the lethal brush fires move closer.

If one spark jumps across the eurozone line, we will have global systemic crisis within days. Are the firemen ready?

They don’t beat around the bush in the U.S. If they want a company, they’re pretty open about it and they let money speak.

They don’t beat around the bush in the U.S. If they want a company, they’re pretty open about it and they let money speak.

Does anybody really know where Amazon is going? The Czech industrial sector hasn’t been getting much sleep lately, what with everyone’s falling over themselves to woo the world’s largest on-line retailer. The site will have to be ready to go almost immediately, and with 30 ha rumored to be needed, there can’t be that much choice.

Does anybody really know where Amazon is going? The Czech industrial sector hasn’t been getting much sleep lately, what with everyone’s falling over themselves to woo the world’s largest on-line retailer. The site will have to be ready to go almost immediately, and with 30 ha rumored to be needed, there can’t be that much choice.